JAN. 2019

The liberal professions are an important driver for the Luxembourg economy. Indeed, this trade represents today more than 6,000 jobs in Luxembourg. Since Bâloise Assurances understands and measures multiple situations in hundreds of different sectors, let's focus more specifically on the liberal professions, and how they can embellish their future.

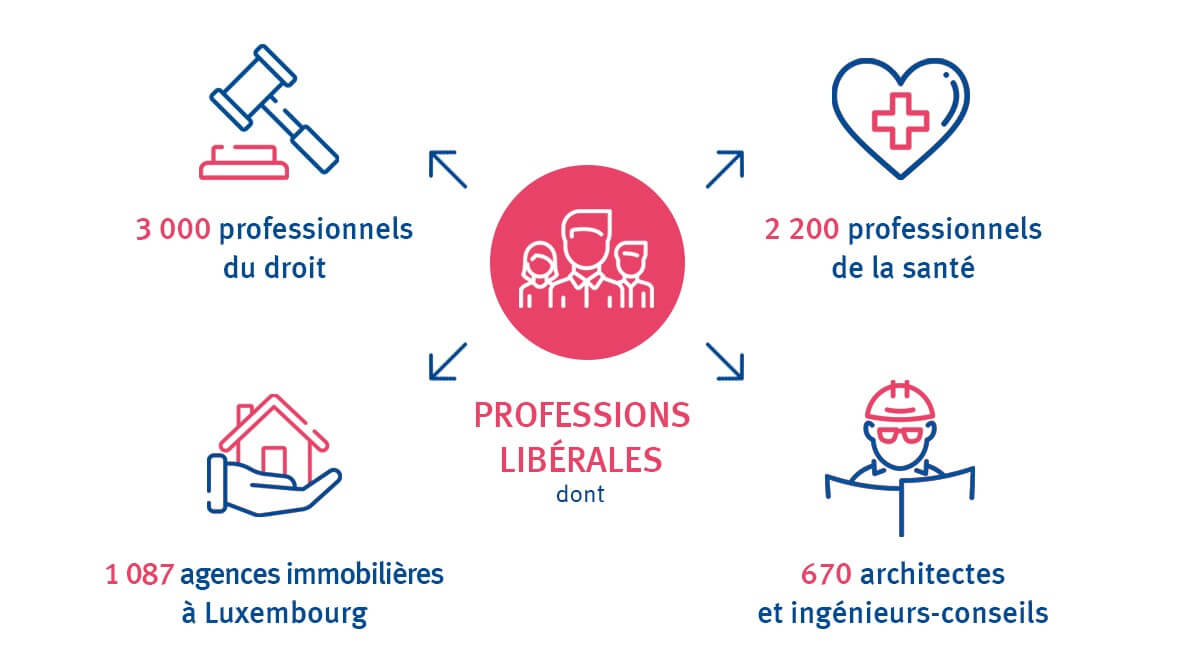

The liberal professions in figures

What about independent intellectual professions, whose production tool is often immaterial?

Including health liberals , including 2,200 general practitioners, specialists and dentists, but also pharmacists, physiotherapists, veterinarians ... Or the 3,000 legal professionals in Luxembourg, the architectural sector (architect, surveyor, consulting engineer ...) the professionals of the figure (fiduciaries, accounting and audit ...), those of the insurance or the council (consultants, trainers, IT freelancers ...). Not to mention the unregulated liberal professions that are communication agencies and freelancers of graphics, design and translation.

On a day-to-day basis, these professions will mainly have significant needs in terms of professional liability (CR), as the consequence of their operations or advice may be crucial for their clients.

But what about for the future ?

Voted July 5 and effective January 1, 2019, Bill 7119 gives the opportunity to all professionals to subscribe to a supplementary pension plan.

By supplementary pension scheme, it is obviously a question of constituting a complementary pension, in a supervised but also advantageous way. The goal is to have a capital at the time of retirement, a pension in case of incapacity for work or a death benefit.

What are the benefits of the supplementary pension scheme ?

As we explained earlier, it is now possible for all liberal professions to freely set up a supplementary pension scheme while benefiting from tax incentives. The applicable tax is, for its part, doubly interesting.

Firstly, the insurance premiums paid to a supplementary scheme of pensions for self-employed persons are included as special expenses in the Luxembourg tax declaration, in the same way as the 3,200 euros paid under the pension insurance scheme (Article 111a LIR). They will be able to raise up to 20% of the annual incomes, without ceiling.

Secondly, the supplementary scheme provides for a 20% discharge tax, so that the retirement benefit is no longer taxed.

Finally, self-employed persons with a supplementary pension scheme may also choose, depending on their needs, the type of investment that is appropriate to fluctuate their investments.

Find all the information about our complementary pension scheme for independent onbaloise.lu/rcpi

This content is brought to you by Bâloise Assurances